15+ Figure mortgage

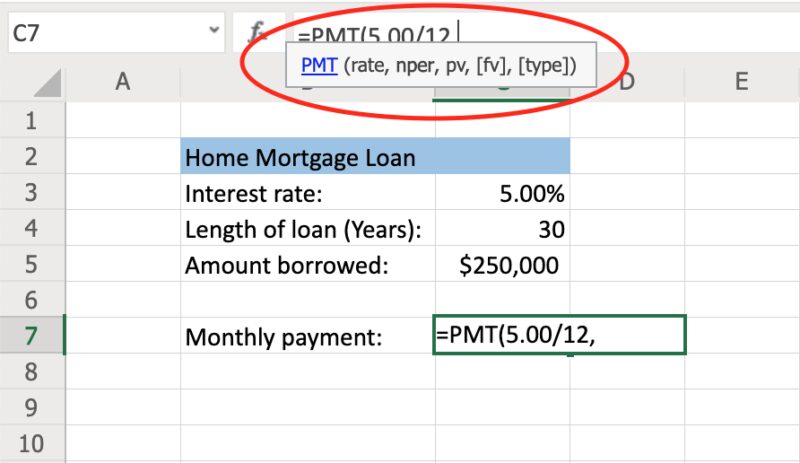

So if your rate is 5 then the monthly rate will look like this. The 15 Year Mortgage Rate forecast at the end of the month 993.

Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Car Loan Calculator Amortization Schedule

The 15 Year Mortgage Rate forecast at the end of the month 1016.

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

. Hopeful homeowners have a number of agencies to turn to in California. 7 tac 80200b consumers wishing to file a complaint against a company or a residential mortgage loan originator should complete and send a complaint form to the texas department of savings and mortgage lending 2601 north lamar suite 201 austin texas 78705. Mortgage approvals Aug 15.

Mortgage rate concerns Jul 18. Figure out how much house you can. The California Housing Finance Agency CalHFA has loan programs such the first mortgage conventional or CalPLUS fixed-rate loan down payment assistance programs and mortgage.

Navy Federal Credit Union. Build home equity much faster. Some are within your control.

Compare and see which option is better for you after interest fees and rates. You come up with a larger down payment. You take out a shorter-term loan such as a 15-year fixed-rate loan.

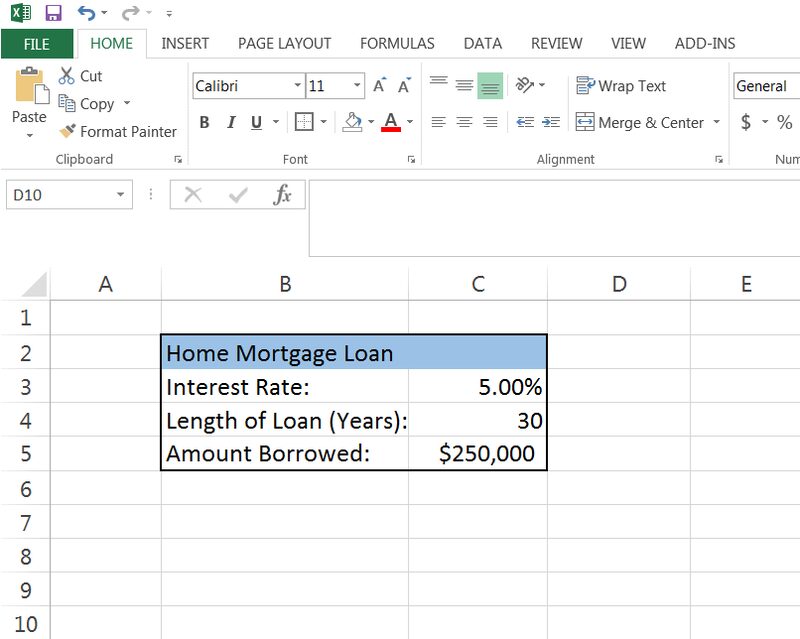

See the monthly cost on a 250000 mortgage over 15- or 30-years. A fixed-rate mortgage is secure but may cost more at the beginning than an adjustable-rate mortgage. Savings totals are calculated using the average mortgage balance average interest rates and average HELOC amount applied for and.

Figures Home Equity Line and Mortgage products require that you pledge your home as collateral and you could lose your home if you fail to repay. On the other hand if rates go up youll eventually pay more for that adjustable-rate loan. Mortgage brokers or correspondent lenders originated the loans described on 37 2868 of the reports of misrepresentation or misuse of loan funds.

If a person. Our refinance calculator helps you quickly figure how long it will take you to recoup closing. Your rate tends to be lower if you have a strong FICO credit score.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. People typically move homes or refinance about every 5 to 7 years. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes.

Homeowners must have mortgage loans insured by CalHFA Mortgage Insurance on or before May 31 2009. Mortgage qualification Aug 1. But some factors are outside your control and.

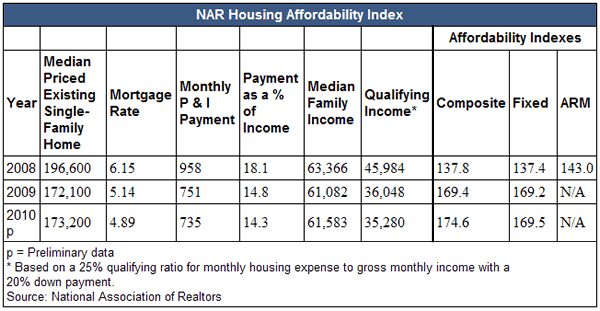

List of all lenders. The average 15-year fixed mortgage rate is 5510 with an APR of 5540. For today Thursday September 15 2022 the national average 15-year fixed mortgage APR is 5540 up compared to last weeks of 5360.

All savings calculations are estimates. Enter the numbers in the box for each item or. The average for the month 973.

The interest rate on your mortgage loan depends on a host of factors. Misuse of FHA Title One loans was reported in 20 155 of these narratives. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

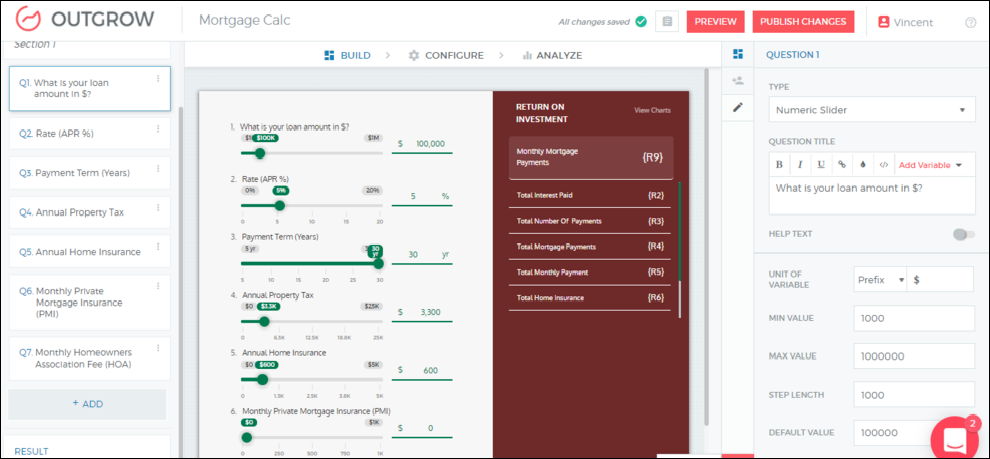

Use this calculator to figure out what you will pay each month for your mortgage the amount of money you intend to borrow to buy your new home. After the Great Depression Fannie Mae was created to add liquidity and securitize the mortgage market allowing homebuyers access to 30-year fixed-rate mortgages. And your monthly debts are low.

15 Year Mortgage Rate forecast for September 2024. The average for the month 1010. Mortgage Interest Rate forecast for August 2024.

Rising mortgage rates Jun 20. In recent years over 90 of residential home loans for owner-occupied dwellings were structured using fixed-rate loans that provide buyers the security. Todays national 15-year mortgage rate trends.

The national average 15-year fixed mortgage APR is 5540 up compared to last weeks of 5360. Misrepresentation of loan purpose or misuse of loan proceeds was described in 129 1226 of the sampled narratives. The average 51 adjustable-rate mortgage ARM rate is 4630 with an APR of 6540.

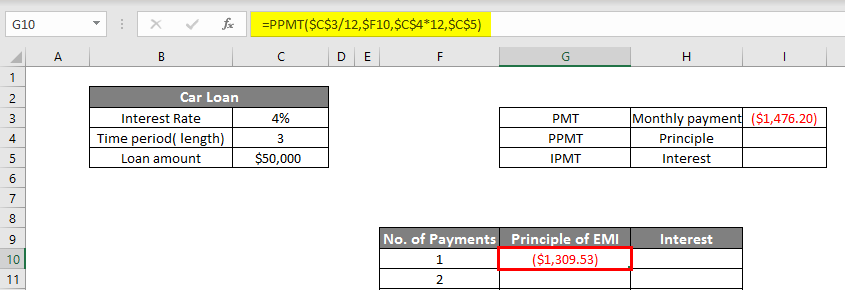

Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. Last-minute mortgages Jul 4. Source Opens a new window.

So if you buy two points at 4000 youll need to write a check for 4000 when. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. One mortgage point typically costs 1 of your loan total for example 2000 on a 200000 mortgage.

Maximum interest rate 1046 minimum 986. Mortgage changes Sep 12.

The Loan Officer Podcast

How To Calculate A Mortgage Payment In Excel Excel Explained

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How 8 Mortgage Rates Will Change The Face Of Homeownership

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How To Build A Mortgage Calculator Interactive Calculator Outgrow

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mct Trading Com Mcttrading Twitter

How To Calculate Monthly Loan Payments In Excel Investinganswers

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free 8 Sample Mortgage Calculator Templates In Pdf Ms Word

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

How To Calculate Monthly Loan Payments In Excel Investinganswers

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator